Everything You Need to Know About Home Equity Loans

페이지 정보

작성자 Autumn 작성일25-01-15 08:31 조회67회 댓글0건관련링크

본문

Subtitle 1: What is a Home Equity Loan?

A house equity mortgage is a type of mortgage that allows householders to borrow money through the use of their home’s equity as collateral. When you are taking out a home fairness mortgage, you would possibly be primarily taking out a loan towards the worth of your personal home. Home fairness loans are typically used for big bills such as home repairs, medical payments, faculty tuition, or to consolidate other money owed.

Subtitle 2: How Does a Home Equity Loan Work?

When you take out a home equity loan, you are primarily borrowing money towards the worth of your home. The sum of money you'll find a way to borrow is set by the amount of fairness you have in your home. Equity is the difference between the market value of your own home and the amount you continue to owe on your mortgage. Home fairness loans normally come with a onerous and fast rate of interest and a onerous and fast term, meaning that you will pay the same amount of interest over the whole period of the mortgage.

Subtitle 3: What Are the Interest Rates on Home Equity Loans?

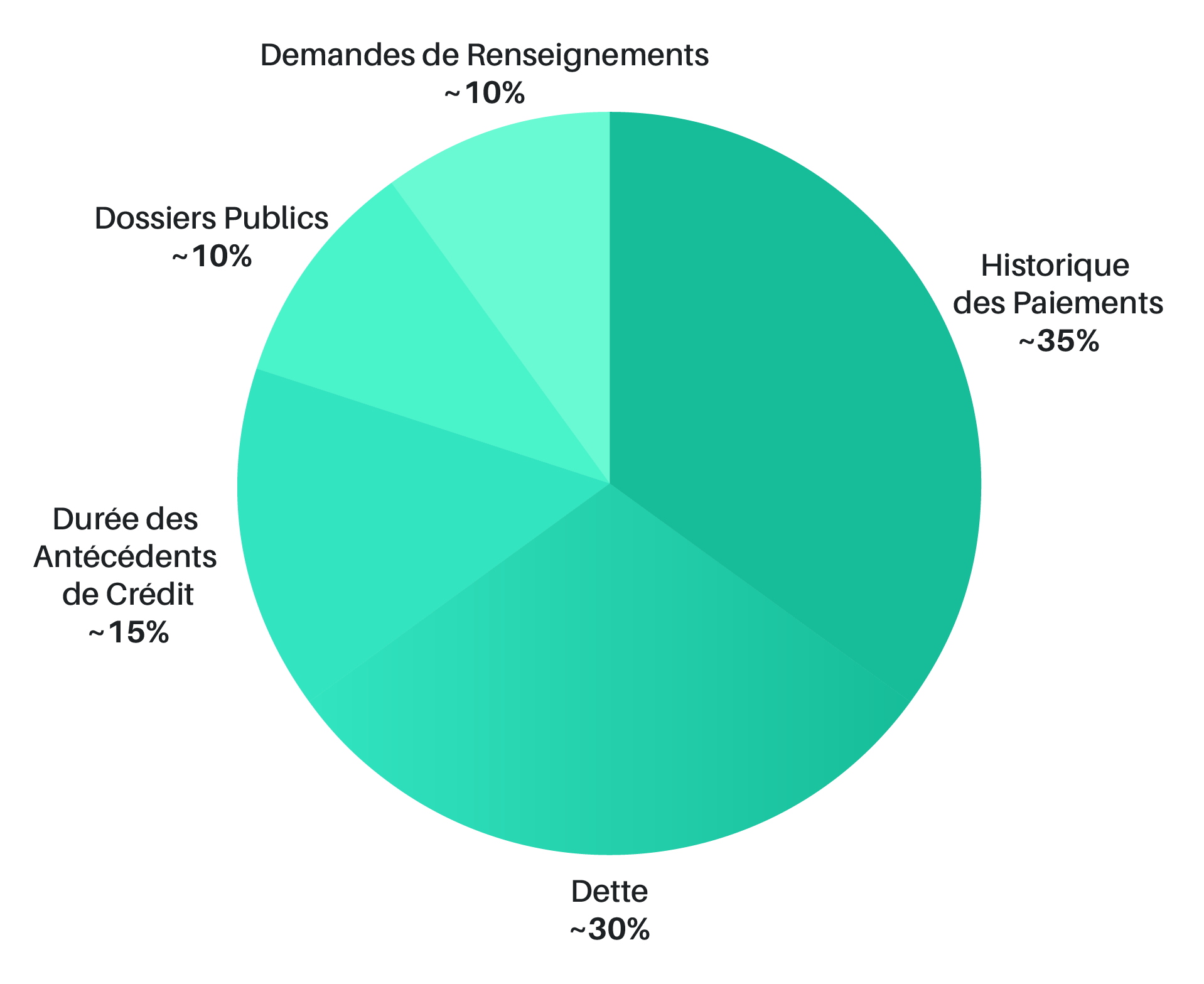

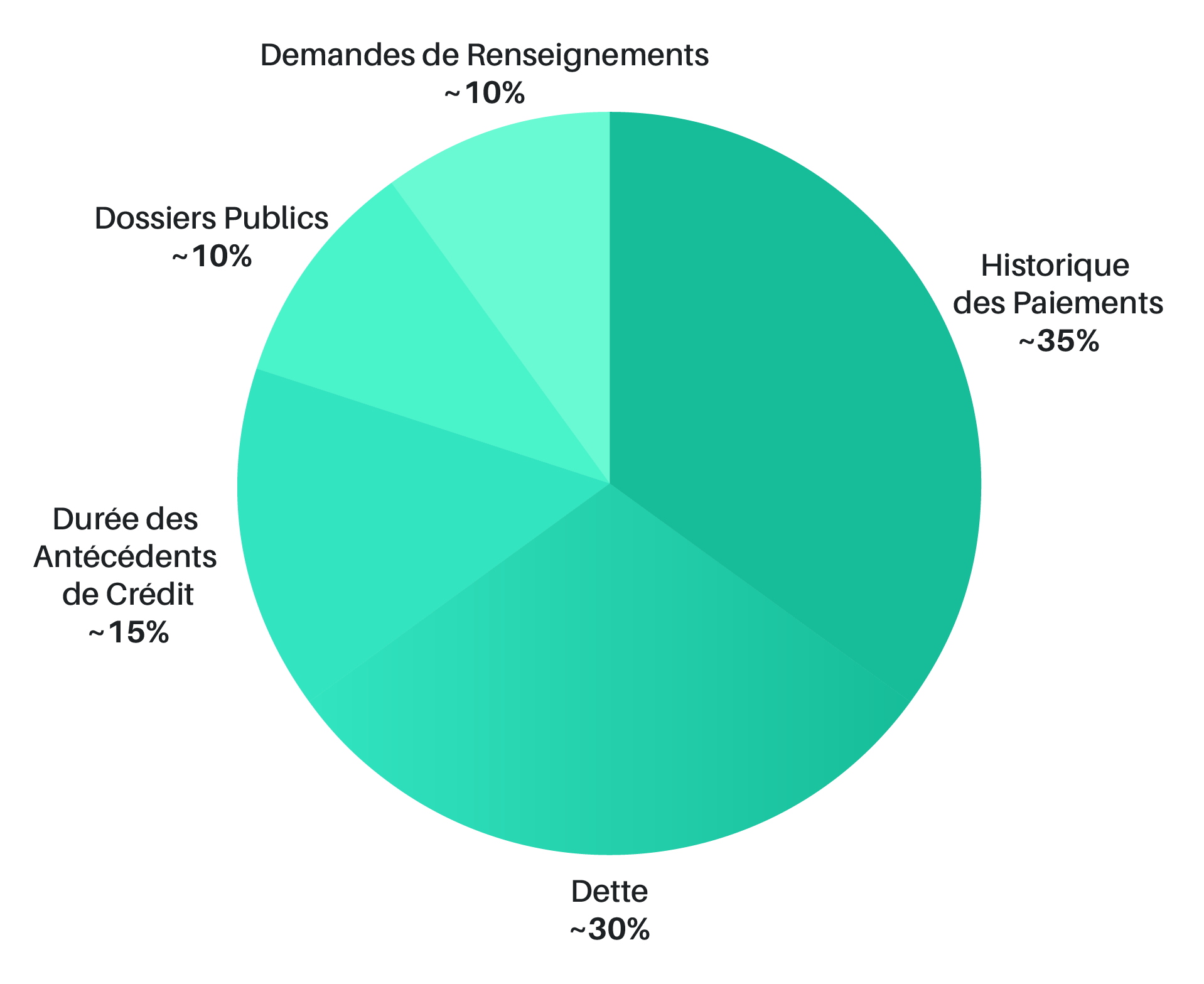

The interest rate on a home fairness loan is dependent upon a selection of elements, including your credit Score De CréDit Conseils essentiels pour améliorer la score de crédit and the loan-to-value (LTV) ratio. Generally speaking, the upper your credit Conseils essentiels pour améliorer la score de crédit, the lower your rate of interest will be. The LTV ratio is the amount of cash you borrow compared to the value of your personal home. A low LTV ratio means you may be borrowing less money and will likely obtain a lower rate of interest.

Subtitle 4: What Are the Benefits of Home Equity Loans?

Subtitle 4: What Are the Benefits of Home Equity Loans?

Home fairness loans supply several benefits over a conventional mortgage. First, the rate of interest is typically decrease than a conventional mortgage, meaning you'll lower your expenses in the lengthy run. Additionally, the loan terms are often shorter, which means you'll pay off the mortgage extra quickly. Finally, you can use the money from a home fairness mortgage for any objective, that means you can use it to pay for residence repairs, medical payments, school tuition, or to consolidate other debts.

Subtitle 5: What Are the Risks of Home Equity Loans?

While house fairness loans include a quantity of benefits, there are also some dangers to suppose about. First, if you fail to make payments on time, you could put your personal home vulnerable to foreclosure. Additionally, relying on the terms of the mortgage, you would possibly have to pay closing costs and other fees. Finally, when you take out a house equity mortgage and the worth of your house decreases, you might find yourself owing more money than your own home is value.

Subtitle 6: Is a Home Equity Loan Right for You?

Home equity loans may be an efficient way to borrow money should you want it for a big expense. However, you will want to weigh the pros and cons earlier than you resolve to take out a house fairness mortgage. Make positive that you understand the dangers and advantages, and just remember to can afford the payments. Finally, it could be very important store round and compare charges to ensure you are getting one of the best deal.

A house equity mortgage is a type of mortgage that allows householders to borrow money through the use of their home’s equity as collateral. When you are taking out a home fairness mortgage, you would possibly be primarily taking out a loan towards the worth of your personal home. Home fairness loans are typically used for big bills such as home repairs, medical payments, faculty tuition, or to consolidate other money owed.

Subtitle 2: How Does a Home Equity Loan Work?

When you take out a home equity loan, you are primarily borrowing money towards the worth of your home. The sum of money you'll find a way to borrow is set by the amount of fairness you have in your home. Equity is the difference between the market value of your own home and the amount you continue to owe on your mortgage. Home fairness loans normally come with a onerous and fast rate of interest and a onerous and fast term, meaning that you will pay the same amount of interest over the whole period of the mortgage.

Subtitle 3: What Are the Interest Rates on Home Equity Loans?

The interest rate on a home fairness loan is dependent upon a selection of elements, including your credit Score De CréDit Conseils essentiels pour améliorer la score de crédit and the loan-to-value (LTV) ratio. Generally speaking, the upper your credit Conseils essentiels pour améliorer la score de crédit, the lower your rate of interest will be. The LTV ratio is the amount of cash you borrow compared to the value of your personal home. A low LTV ratio means you may be borrowing less money and will likely obtain a lower rate of interest.

Subtitle 4: What Are the Benefits of Home Equity Loans?

Subtitle 4: What Are the Benefits of Home Equity Loans?Home fairness loans supply several benefits over a conventional mortgage. First, the rate of interest is typically decrease than a conventional mortgage, meaning you'll lower your expenses in the lengthy run. Additionally, the loan terms are often shorter, which means you'll pay off the mortgage extra quickly. Finally, you can use the money from a home fairness mortgage for any objective, that means you can use it to pay for residence repairs, medical payments, school tuition, or to consolidate other debts.

Subtitle 5: What Are the Risks of Home Equity Loans?

While house fairness loans include a quantity of benefits, there are also some dangers to suppose about. First, if you fail to make payments on time, you could put your personal home vulnerable to foreclosure. Additionally, relying on the terms of the mortgage, you would possibly have to pay closing costs and other fees. Finally, when you take out a house equity mortgage and the worth of your house decreases, you might find yourself owing more money than your own home is value.

Subtitle 6: Is a Home Equity Loan Right for You?

Home equity loans may be an efficient way to borrow money should you want it for a big expense. However, you will want to weigh the pros and cons earlier than you resolve to take out a house fairness mortgage. Make positive that you understand the dangers and advantages, and just remember to can afford the payments. Finally, it could be very important store round and compare charges to ensure you are getting one of the best deal.